The microencapsulated pesticides market is riding a powerful growth curve, fueled by demand for smarter agriculture, regulatory shifts, and innovation across formulation technologies. In 2024, MRFR placed the market size at USD 315.20 billion, with projections reaching USD 797.25 billion by 2035, reflecting a CAGR of 8.80 % between 2024 and 2035.

While that gives a high-level lens, the nuances—segmental shifts, regional dynamics, innovation fronts—are where opportunity and risk lie. This blog dives into the major trends and the trajectory ahead.

Trend 1: Sustainability & Regulatory Pressure as Catalysts

Governments and agricultural agencies are imposing stricter residue limits, pushing farmers toward formulations that leave minimal trace. Microencapsulated pesticides fit well in this paradigm by controlling release and minimizing drift.

Simultaneously, consumers demand “cleaner” produce, which creates pressure upstream. In many regions, regulatory support is emerging for advanced, lower-impact pesticide technologies.

Trend 2: Biopesticide + Encapsulation Hybridization

One of the more compelling frontiers is the marriage of biocontrol (natural agents) and microencapsulation. Encapsulating beneficial microbes or botanical actives opens doors in organic, integrated pest management (IPM), or low-residue markets.

This hybrid space is likely to attract startups, specialty players, and research funding, especially where synthetic pesticide regulation is tightening.

Trend 3: Precision Agriculture Integration

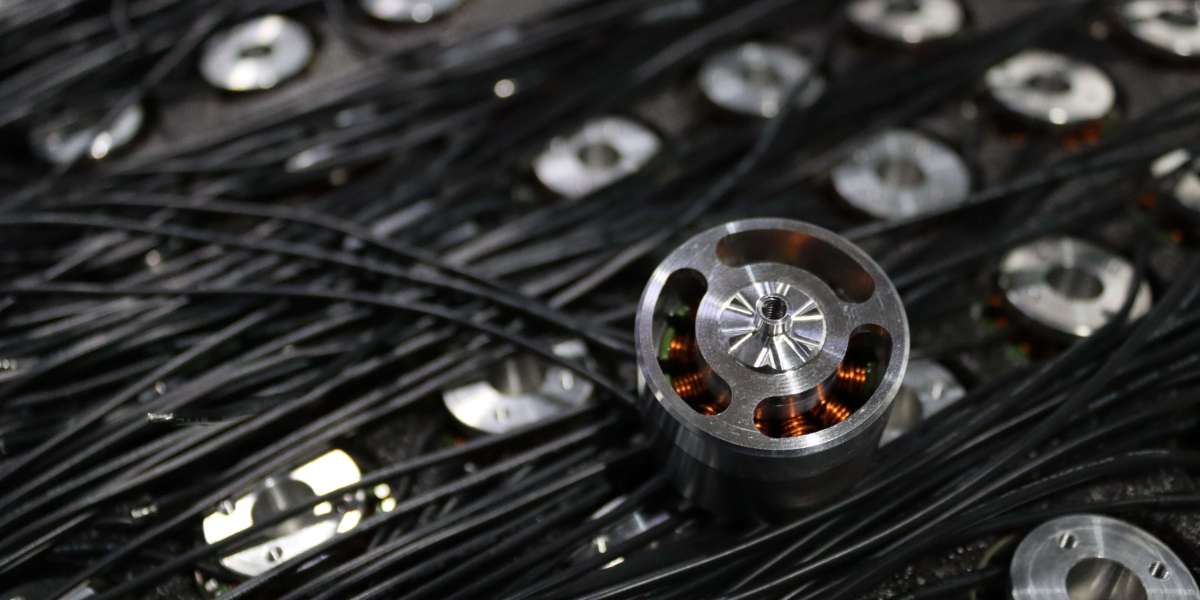

Microencapsulated formulations are naturally compatible with precision spraying systems (drones, sensor-based variable-rate sprayers). Because of their controlled release nature, they reduce waste and help tailor dose by zone.

Some studies report active-ingredient savings of 20–30% when combining encapsulated products with smart application systems (per market intelligence).

Trend 4: Smarter Capsules & Triggerable Release

Future differentiators will be in “triggered release” systems—microcapsules that respond to moisture, pH, pests’ enzymes, or temperature. These offer enhanced control and reduced background exposure.

Materials science (e.g. biodegradable polymers, stimuli-responsive shells) is a field to watch.

Trend 5: Emerging Market Penetration

While North America and Europe lead in absolute value, Asia Pacific (especially South Asia, Southeast Asia), Latin America, and parts of Africa are seeing rising adoption as farmers modernize.

In many such areas, a leapfrog effect is possible: farmers skip older bulk formulations and go straight to next-gen encapsulated products. MRFR notes high growth potential in emerging geographies.

Trend 6: Consolidation, Partnerships & Innovation Ecosystems

To succeed, many firms are pursuing joint ventures, licensing, and partnerships—especially between formulation innovators, polymer chemists, and agritech players.

Acquisitions by large agrochemical players to absorb microencapsulation capabilities or portfolios are likely.

Risks & Trend Headwinds

Regulatory lag for novel materials

Resistance from conventional pesticide incumbents

Cost competitiveness vs. older formulations

Farmer education and trust barrier

Genetic and environmental variability regionally that demands local adaptation

What to Watch in 3–5 Years

Which capsule trigger systems reach commercial scale?

How fast will adoption in smallholder systems (e.g. Asia, Africa) scale?

What degree of synergy will form between encapsulation firms and agtech (drones, sensor platforms)?

Will regulatory frameworks begin favoring encapsulated systems (e.g. faster registration, incentives)?

How will margin competition drive cost reductions in encapsulation?

Conclusion

The microencapsulated pesticides market is not just growing—it is evolving rapidly. The paths of sustainability, precision agriculture, hybrid biopesticide strategies, and materials innovation create a rich tapestry of opportunity. Players who align with these trends—in technology, partnerships, cost structuring, and field outreach—are likely to ride the next wave of growth.